- Home

- Figures

- Foreword

- Executive Board

- Share

-

Management report

- Foundations of the Group

- Report on economic position

-

Group non-financial information statement

- Introduction

- Description of the business model

- Group and sustainability strategy

- Responsible enterprise management

- Compliance

- Stakeholder dialogue

- Sustainable insurance solutions

- ESG criteria in asset management

- Customer orientation and satisfaction

- Executive development / Employee advancement

- Employee retention

- Diversity

-

Opportunity and risk report

-

Risk report

- Strategy implementation

- Major external factors

- Risk capital

- Risk management

- Risk management system

- Internal control system

- Risk landscape of Hannover Re

- Internal risk assessment

- Underwriting risks in property and casualty reinsurance

- Underwriting risks in life and health reinsurance

- Market risks

- Counterparty default risks

- Operational risks

- Other risks

- Opportunity report

-

Risk report

- Enterprise management

- Outlook

- Accounts

- Supervisory Board

- Sites

Investments

Our portfolio of assets under own management amounted to EUR 40.1 billion, a level lower than at the end of the previous year (31 December 2016: EUR 41.8 billion). This decline primarily reflects exchange rate effects – especially the strength of the EUR o against the US dollar. These were offset to some extent by the pleasing operating cash flow.

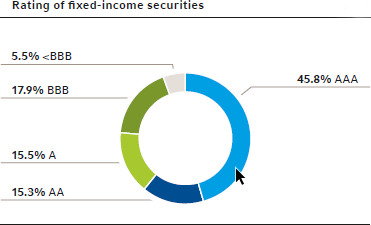

In response to the challenging interest rate environment we had already taken steps in the previous year to adjust the allocation of our investments to individual classes of securities such that we further enlarged our holding of fixed-income securities rated BBB or lower while at the same time increasing the proportion of government bonds in our portfolio. In this way we can achieve increased liquidity of the portfolio and generate continued stable returns, while maintaining the overall risk level of our fixed-income portfolio virtually unchanged. We continued with this regrouping in the year under review. In addition, we reduced the proportion of covered bonds.

At the end of the third quarter we responded to the hurricane events in the United States and the Caribbean as well as the earthquakes in Mexico by liquidating our holdings of non-strategic listed equities and equity funds. In so doing, we took advantage of the favourable state of the market, reduced our general risk position and freed up capital for possible risk allocations. We also further increased slightly the share attributable to real estate as part of the strategic expansion of this asset category. In all other asset classes we made only minimal changes in the context of regular portfolio maintenance.

The portfolio of fixed-income securities excluding short-term assets contracted to EUR 34.3 billion (EUR 35.5 billion). This decline can similarly be attributed principally to exchange rate effects. Hidden reserves for available-for-sale fixed-income securities, which are allocable to shareholders' equity, totalled EUR 706.2 million (EUR 728.2 million) on balance. This reflects the yield increases observed in the course of the reporting period, especially in the area of EUR- and GBP-denominated sovereign bonds and debt securities issued by semi-governmental entities, which were offset to some extent by lower risk premiums on corporate bonds. As to the quality of the bonds – measured in terms of rating categories – the proportion of securities rated “A” or better remained on a consistently high level as at year-end at 76.6% (77.6%).

Holdings of alternative investment funds increased slightly overall. As at 31 December 2017 an amount of EUR 776.3 million (EUR 722.4 million) was invested in private equity funds; a further EUR 818.3 million (EUR 750.7 million) was attributable predominantly to investments in high-yield bonds and loans. In addition, altogether EUR 385.0 million (EUR 390.7 million) was invested in structured real estate investments. The uncalled capital with respect to the aforementioned alternative investments totalled EUR 1,201.9 million (EUR 1,096.4 million).

Furthermore, we made the most of market opportunities available to our US real estate portfolio by both selling and acquiring one office building. Our real estate portfolios in Asia and Eastern Europe were similarly enlarged. In Germany, on the other hand, we acted on sales opportunities for two of our properties, although we also consolidated our portfolio through the acquisition of a new property. Our real estate allocation consequently rose slightly. It currently stands at 5.3% (4.6%). As at the end of the year under review we held a total amount of EUR 1.8 billion (EUR 1.7 billion) in short-term investments and cash. Funds withheld amounted to EUR 10.9 billion (EUR 11.8 billion).