- Home

- Figures

- Foreword

- Executive Board

- Share

-

Management report

- Foundations of the Group

- Report on economic position

-

Group non-financial information statement

- Introduction

- Description of the business model

- Group and sustainability strategy

- Responsible enterprise management

- Compliance

- Stakeholder dialogue

- Sustainable insurance solutions

- ESG criteria in asset management

- Customer orientation and satisfaction

- Executive development / Employee advancement

- Employee retention

- Diversity

-

Opportunity and risk report

-

Risk report

- Strategy implementation

- Major external factors

- Risk capital

- Risk management

- Risk management system

- Internal control system

- Risk landscape of Hannover Re

- Internal risk assessment

- Underwriting risks in property and casualty reinsurance

- Underwriting risks in life and health reinsurance

- Market risks

- Counterparty default risks

- Operational risks

- Other risks

- Opportunity report

-

Risk report

- Enterprise management

- Outlook

- Accounts

- Supervisory Board

- Sites

Annual Report 2017

Remuneration of the Executive Board

-

Responsibility

In order to efficiently perform its tasks the Supervisory Board has formed various committees. The Standing Committee prepares remuneration-related matters of content relating to the Executive Board for discussion and adoption of a resolution by a full meeting of the Supervisory Board.

-

Objective, structure and system of Executive Board remuneration

The total remuneration of the Executive Board and its split into fixed and variable components conform to regulatory requirements – especially the provisions of the Act on the Adequacy of Management Board Remuneration (VorstAG) and of Art. 275 Commission Delegated Regulation (EU) 2015 / 35 and supplemented by those of the Regulation on the Supervisory Law Requirements for Remuneration Schemes in the Insurance Sector (VersVergV). An independent expert’s report from June 2017 confirms that the system of remuneration meets the requirements of Art. 275 Commission Delegated Regulation (EU) 2015 / 35 for a remuneration policy and remuneration practices that are in line with the undertaking’s business, strategy and risk profile.

The amount and structure of the remuneration of the Executive Board are geared to the size and activities of the company, its economic and financial position, its success and future prospects as well as the customariness of the remuneration, making reference to the benchmark environment (horizontal) and the remuneration structure otherwise applicable at the company (vertical). The remuneration is also guided by the tasks of the specific member of the Executive Board, his or her individual performance and the performance of the full Executive Board.

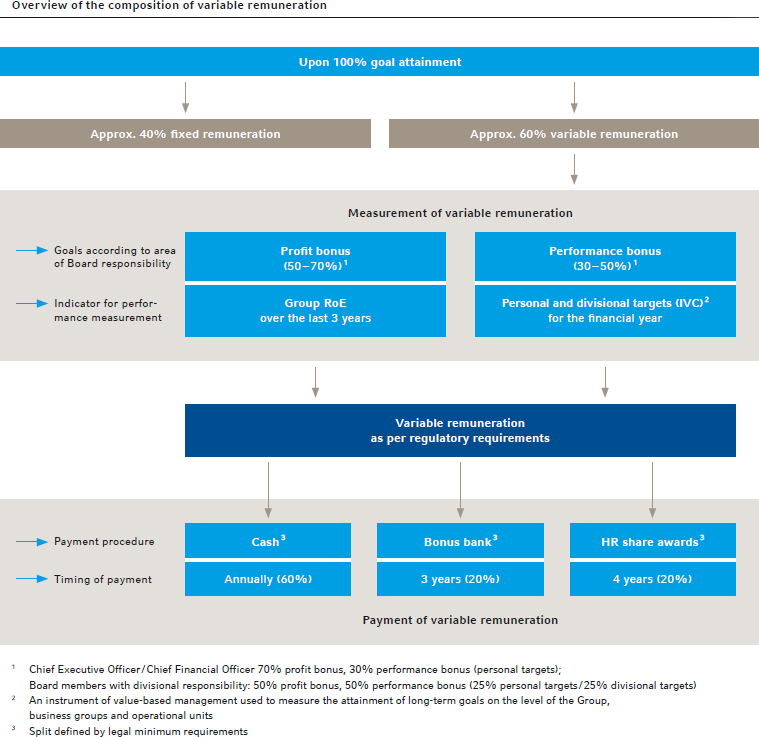

With an eye to these objectives, the remuneration system has two components: fixed salary / non-cash compensation and variable remuneration. The variable remuneration is designed to take account of both positive and negative developments. Overall, the remuneration is to be measured in such a way that it reflects the company’s sustainable development and is fair and competitive by market standards. In the event of 100% goal attainment the remuneration model provides for a split into roughly 40% fixed remuneration and roughly 60% variable remuneration.

-

Fixed remuneration (approx. 40% of total remuneration upon 100% goal attainment)

Measurement basis and payment procedures for fixed remuneration Components Measurement basis / parameters Condition of payment Paid out Basic remuneration;

Non-cash compensation, fringe benefits: Accident, liability and luggage insurance, company car for business and – if desired – personal use (tax on the non-cash benefit payable by the Board member), reimbursement of travel expenses and other expenditures incurred in the interest of the companyFunction, responsibility, length of service on the Executive Board

Remuneration reviewed by the Supervisory Board normally at two-year intervals. Since 2014 gradual conversion of Executive Board contracts: review of annual fixed salary during the contract period no longer applies.Contractual stipulations 12 equal monthly instalments -

Variable remuneration (approx. 60% of total remuneration upon 100% goal attainment)

The profit- and performance-based remuneration (variable remuneration) is contingent on certain defined results and the attainment of certain set targets. The set targets vary according to the function of the Board member in question. The variable remuneration consists of a profit bonus and a performance bonus.

The variable remuneration is defined at the Supervisory Board meeting that approves the consolidated financial statement for the financial year just ended.

The following chart summarises the make-up of the variable remuneration components. For details of measurement and payment procedures please see the two tables following the chart.

Measurement bases / conditions of payment for variable remuneration Component Measurement basis / parameters Condition of payment Profit bonus Proportion of variable remuneration: Chief Executive Officer / Chief Financial Officer: 70%; Board member with divisional responsibility: 50% The profit bonus is dependent on the risk-free interest rate and the average Group return on equity (RoE) of the past three financial years.

An individually determined and contractually defined basic amount is paid for each 0.1 percentage point by which the RoE of the past three financial years exceeds the risk-free interest rate. Goal attainment of 100% corresponds to an RoE of 8.8% plus the riskfree interest rate (2017: 0.76%). Goal attainment can amount to a maximum of 200% and a minimum of -100%.

The IFRS Group net income (excluding non-controlling interests) and the arithmetic mean of the IFRS Group shareholders’ equity (excluding non-controlling interests) at the beginning and end of the financial year are used to calculate the RoE.

The risk-free interest rate is the average market rate for 10-year German government bonds over the past five years, with the average being calculated on the basis of the respective interest rate at year- end.Contractual stipulations

Attainment of three-year targets

Decision of the Supervisory BoardPerformance bonus

The performance bonus for the Chief Executive Officer and the Chief Financial Officer is arrived at from individual qualitative and, as appropriate, quantitative targets defined annually by the Supervisory Board that are to be accomplished in the subsequent year. For members of the Executive Board with responsibility for a certain division, the performance bonus consists in equal parts of the divisional bonus and the individual bonus.Divisional bonus

Proportion of variable remuneration: Board member with divisional responsibility: 25%The basis for the divisional bonus is the return generated on the capital allocated to the division in the respective 3-year period just ended (= RoCA (Return on Capital Allocated)).

An individually determined amount specified in the service contract is calculated for each 0.1 percentage point by which the average 3-year RoCA exceeds the level of 0%.

Goal attainment of 100% is achieved in property and casualty reinsurance with a RoCA of 9.1% and in life and health reinsurance with a RoCA of 10.1%. These RoCA values are above the cost of capital and thus generate positive intrinsic value creation (IVC) 1.

Goal attainment can amount to a maximum of 200% and a minimum of -100%.

The method used to calculate the IVC as a basis for determining the divisional performance is checked by independent experts.

The divisional bonus is determined by the Supervisory Board according to its best judgement. The determination also takes into account, in particular, the contribution made by the business under the responsibility of the Board member concerned to the achieved divisional performance and the relative change in the average IVC in the remuneration year. The Supervisory Board may make additions to or deductions from the arithmetically calculated values at any time in the event of over- or underfulfilment of the criteria.Attainment of three-year targets

Contractual agreement

Decision of the Supervisory Board according to its best judgementIndividual bonus

Proportion of variable remuneration: Chief Executive Officer / Chief Financial Officer: 30%; Board member with divisional responsibility: 25%Personal qualitative, quantitative targets (individual contribution to the overall result, leadership skills, innovative skills, entrepreneurial skills, specific features of area of responsibility).

The individual bonus for goal attainment of 100% is contractually stipulated. Over- and underfulfilment result in additions / deductions.

A General Performance Bonus geared to the individual overall performance of the member of the Executive Board can be determined by the Supervisory Board as part of the individual bonus.

The minimum individual bonus amounts to EUR 0 and the maximum is double the bonus payable upon complete goal attainment.Attainment of annual targets

Decision by the Supervisory Board according to its best judgement.1 An instrument of value-based management used to measure the attainment of long-term goals on the level of the Group, business groups and operational units (see also page 18 et seq.). Payment procedures for the total variable remuneration

Of the total amount of defined variable remuneration, a partial amount of 60% is paid out in the month following the Supervisory Board meeting that approves the consolidated financial statement. The remaining amount of 40% is initially withheld as explained below with a view to encouraging long-term value creation:Payment procedures for the total variable remuneration Short-term Medium-term Long-term 60% of the variable remuneration with the next monthly salary payment

following the Supervisory Board resolution20% of the variable remuneration in the bonus bank;

withheld for three years;

the positive amount contributed three years prior to the payment date is available for payment, provided this does not exceed the balance of the bonus bank in light of credits / debits up to and including those for the financial year just ended;

an impending payment not covered by a positive balance in the bonus bank is omitted;

a positive balance in the bonus bank is carried forward to the following year after deduction of any payment made; a negative balance is not carried forward to the following year;

loss of claims due from the bonus bank in special cases: resignation from office without a compelling reason; contract extension on the same conditions is rejected;

no interest is paid on credit balances.Automatic granting of virtual Hannover Re share awards (HR-SAs) with a value equivalent to 20% of the variable remuneration;

payment of the value calculated at the payment date after a vesting period of four years;

value of the share on awarding / payment: unweighted arithmetic mean of the Xetra closing prices five trading days before to five trading days after the meeting of the Supervisory Board that approves the consolidated financial statement;

additional payment of the sum total of all dividends per share paid out during the vesting period;

changes in a cumulative amount of 10% or more in the value of the HR-SAs caused by structural measures trigger an adjustment;

the Board member has no entitlement to the delivery of shares.Negative variable total bonus = payment of EUR 0 variable remuneration. Any minus value of the variable total bonus for a financial year is transferred in full to the bonus bank (see “Medium-term” column). -

Handling of payment of variable remuneration components in special cases

In the event of voluntary resignation or termination / dismissal by the company for a compelling reason or if an offered contract extension on the same conditions (exception: the member of the Executive Board has reached the age of 60 and has served as a member of the Executive Board for two terms of office) is declined, all rights to payment of the balances from the bonus bank and from the HR-SAs are forfeited.

If the contractual relationship ends normally prior to the end of the vesting period for the bonus bank or HR-SAs, and if a contract extension is not offered, the member of the Executive Board retains his entitlements to payment from the bonus bank – making reference to a defined forward projection of the bonus bank – and for already awarded HR-SAs.

All claims to the allocation of amounts to the bonus bank and / or awarding of HR-SAs after leaving the company are excluded. In cases where an individual leaves the company because of non-reappointment, retirement or death this shall not apply with respect to claims to variable remuneration acquired (pro rata) in the final year of the Board member’s work for the company.

-

Variable remuneration under the old remuneration structure (until 2011)

The virtual stock option plan with stock appreciation rights existing under the old remuneration structure remains in force for all members of the Executive Board until all stock appreciation rights have been exercised or have lapsed. In the 2017 financial year no further stock appreciation rights were granted to active Board members. Of the stock appreciation rights granted in previous years, active and former Board members exercised amounts totalling EUR 0.6 million (previous year: EUR 0.7 million) in 2017.

As at 31 December 2017 active members of the Executive Board had at their disposal a total of 293 (39,585) granted, but not yet exercised stock appreciation rights with a fair value of EUR 9.4 thousand (EUR 366.7 thousand).

-

Continued payment in case of disability

In the event of temporary incapacity for work the fixed annual salary shall continue to be paid in the same amount, at most until termination of the service contract.

If a member of the Executive Board is permanently incapacitated for work during the period of the service contract, the service contract shall terminate at the end of the sixth month after which the permanent incapacity for work is established – although no later than at the end of the service contract.

-

Other information

The contracts of the Board members do not include a commitment to benefits in the event of a premature termination of employment on the Executive Board owing to a change of control. Only the conditions for the granting of share-based remuneration in the form of stock appreciation rights provide for special exercise options in the event of the merger, spin-off or demerger of Hannover Re into another legal entity.

With regard to Item 4.2.3. Para. 2 “Caps on the amount of variable compensation elements in management board contracts” and Item 4.2.3 Para. 4 “Caps on severance payments in management board contracts” of the German Corporate Governance Code, we would refer the reader to our remarks in the 2017 Declaration of Conformity contained in the section “Statement of enterprise management practices”of this Group Annual Report.

-

Amount of remuneration received by the Executive Board

The total remuneration received by the Executive Board of Hannover Rück SE on the basis of its work for Hannover Rück SE and the companies belonging to the Group is calculated from the sum of all the components set out in the following table pursuant to DRS 17.

The remuneration (excluding pension payments) received by former members of the Executive Board totalled EUR 0.2 million (EUR 0.3 million).

Total remuneration of the active members of the Executive Board pursuant to DRS 17 Total Number of share awards6

2016 = Actual

2017 = EstimateName Financial year Non-performance-based remuneration Performance-based remuneration1 Basic salary Non-cash compensation / fringe benefits2 Short-term Medium-term Long-term Variable remuneration payable Bonus bank Share awards in EUR thousand 60%3 Netted remuneration from seats with Group bodies 20% (allocation)4 20% (allocation)5 Ulrich Wallin 2017 605.9 13.9 682.6 227.5 227.5 1,757.4 2,132 2016 596.4 14.2 788.0 262.7 262.7 1,924.0 2,248 Sven Althoff 2017 296.7 16.7 305.8 101.9 101.9 823.0 1,007 2016 280.0 15.6 419.0 139.7 139.7 994.0 1,132 Claude Chèvre 2017 380.0 1.8 404.1 134.8 134.8 1,055.5 1,241 2016 380.0 13.6 476.8 158.9 158.9 1,188.2 1,475 Jürgen Gräber 2017 463.4 15.0 446.9 149.0 149.0 1,223.3 1,470 2016 445.1 7.1 615.3 205.1 205.1 1,477.7 1,615 Dr. Klaus Miller 2017 374.0 3.1 333.0 111.0 111.0 932.1 1,043 2016 356.1 3.9 400.8 133.6 133.6 1,028.0 1,219 Dr. Michael Pickel 2017 374.0 19.8 321.7 3.3 107.2 107.2 929.9 1,084 2016 356.1 12.6 478.0 159.3 159.3 1,165.3 1,270 Roland Vogel 2017 450.7 16.5 497.4 67.0 165.8 165.8 1,296.2 1,560 2016 422.9 17.0 450.6 58.2 150.2 150.2 1,190.9 1,285 Total 2017 2,944.7 86.8 2,991.5 70.3 997.2 997.2 8,017.4 9,537 Total 2016 2,836.6 84.0 3,628.5 58.2 1,209.5 1,209.5 8,968.1 10,244 1As at the balance sheet date no Board resolution was available regarding the performance-based remuneration for 2017. The variable remuneration is recognised on the basis of estimates and the provisions constituted accordingly.

2 The non-cash compensation has been carried in the amounts established for tax purposes.

3 In 2017 EUR 8,500 less in variable remuneration was paid out to Board members for 2016 than had been reserved.

4 The nominal amount is stated; full or partial repayment in 2021, depending on the development until such time of the balance in the bonus bank. In 2017 altogether EUR 2,800 less than had been originally reserved was allocated to the bonus bank for 2016.

5 The nominal amount is stated; virtual Hannover Re share awards are automatically granted in an amount equivalent to 20% of the variable remuneration. The equivalent amount will be paid in 2022 at the prevailing share price of Hannover Re. In 2017 nominal amounts of EUR 2,800 less than had been originally reserved were used as a basis for allocation of the 2016 share awards.

6 In order to calculate the number of share awards for 2017 reference was made to the Xetra closing price of the Hannover Re share on 29 December 2017 (EUR 104.90). The number to be actually awarded is established from the arithmetic mean of the Xetra closing prices of the Hannover Re share in a period from five trading days before to five trading days after the meeting of the Supervisory Board that approves the consolidated financial statement in March 2018. The applicable market price of the Hannover Re share had increased from EUR 102.80 (30 December 2016) to EUR 107.15 by the allocation date (16 March 2017) of the share awards for 2016; the share awards actually allocated for 2016 are shown here, not those estimated in the 2016 Annual Report.The following table shows the expense for share-based remuneration of the Executive Board in the financial year.

The table is to be viewed independently of the presentation of the total remuneration received by active members of the Executive Board pursuant to DRS 17.

Total expense for share-based remuneration of the Executive Board Name

in EUR thousandYear Stock appreciation rights exercised Change in reserve in 2017 for stock appreciation rights Payment of share awards Change in reserve for share awards from previous years1 Expense for share awards allocated in current financial year2 Total Ulrich Wallin 2017 102.6 (102.6) 406.6 (88.6) 76.6 394.6 2016 102.6 (82.8) 608.8 (452.8) 60.5 236.3 Sven Althoff3 2017 25.7 (24.0) 109.6 18.9 20.3 150.5 2016 44.6 (37.6) 0.0 60.9 24.1 92.0 Claude Chèvre 2017 – – 232.8 (35.8) 45.9 242.9 2016 – – 56.5 106.6 40.0 203.1 Jürgen Gräber 2017 89.2 (89.2) 316.6 (93.9) 32.4 255.1 2016 89.2 (72.0) 427.3 (308.7) 34.3 170.1 Dr. Klaus Miller 2017 14.9 (14.9) 232.8 (119.0) 21.0 134.8 2016 14.9 (12.0) 329.3 (171.9) 48.4 208.7 Dr. Michael Pickel 2017 80.3 (80.3) 232.8 (175.0) 21.9 79.7 2016 80.3 (64.8) 326.2 (142.3) 71.3 270.7 Roland Vogel 2017 44.6 (44.6) 250.1 (72.7) 31.5 208.9 2016 44.6 (36.0) 389.7 (332.6) 26.1 91.8 Gesamt 2017 357.3 (355.6) 1,781.3 (566.1) 249.6 1,466.5 Gesamt 2016 376.3 (305.2) 2,137.8 (1,240.8) 304.7 1,272.7 1 The change in the reserve for share awards from previous years derives from the higher market price of the Hannover Re share, the dividend approved for 2016, the spreading of the expense for share awards across the remaining period of the individual service contracts and the payout of the share awards allocated for 2012.

2 The expense for share awards is spread across the remaining period of the individual service contracts. This gives rise to a difference relative to the nominal amount shown in the table of total remuneration.

3 The expenses for stock appreciation rights of Mr. Althoff and the payment of share awards to him relate to his work as a senior executive until 2014.The following two tables show the remuneration of the Executive Board in the 2017 financial year in accordance with the recommendations of the German Corporate Governance Code:

German Corporate Governance Code, Item 4.2.5 Para. 3 – Table 1 (target / minimum / maximum remuneration as nominal amounts) Benefits granted Ulrich Wallin

Chief Executive OfficerSven Althoff

Board member with divisional responsibilityClaude Chévre

Board member with divisional responsibilityJürgen Gräber

Board member with divisional responsibility Coordinator of worldwide property & casualty reinsurancein EUR thousand 2016 2017 2017

(Min)2017

(Max)2016 2017 2017

(Min)2017

(Max)2016 2017 2017

(Min)2017

(Max)2016 2017 2017

(Min)2017

(Max)Fixed remuneration 596.4 605.9 605.9 605.9 280.0 296.7 296.7 296.7 380.0 380.0 380.0 380.0 445.1 463.4 463.4 463.4 Fringe benefits 14.2 13.9 13.9 13.9 15.6 16.7 16.7 16.7 13.6 1.8 1.8 1.8 7.1 15.0 15.0 15.0 Total 610.6 619.8 619.8 619.8 295.6 313.4 313.4 313.4 393.6 381.8 381.8 381.8 452.2 478.4 478.4 478.4 One-year variable remuneration 504.0 523.0 0.0 1,046.0 252.0 267.0 0.0 534.0 342.0 342.0 0.0 684.0 360.0 390.0 0.0 780.0 Multi-year variable remuneration 390.8 400.8 (558.0) 749.6 188.7 201.0 (267.2) 379.0 260.6 260.1 (395.4) 488.1 281.5 298.8 (448.7) 558.8 Bonusbank 2015 (20191) / 2016 (20201) 168.0 174.3 (610.2) 348.7 84.0 89.0 (290.2) 178.0 114.0 114.0 (427.5) 228.0 120.0 130.0 (487.5) 260.0 Share Awards 2015 (20201) / 2016 (20211)2 168.0 174.3 0.0 348.7 84.0 89.0 0.0 178.0 114.0 114.0 0.0 228.0 120.0 130.0 0.0 260.0 Dividend on share awards for 20143 54.8 0.0 0.0 0.0 20.7 0.0 0.0 0.0 32.6 0.0 0.0 0.0 41.5 0.0 0.0 0.0 Dividend on share awards for 2015 0.0 52.2 52.2 52.2 0.0 23.0 23.0 23.0 0.0 32.1 32.1 32.1 0.0 38.8 38.8 38.8 Total 1,505.4 1,543.6 61.8 2,415.4 736.3 781.4 46.2 1,226.4 996.2 983.9 (13.6) 1,553.9 1,093.7 1,167.2 29.7 1,817.2 Service cost4 144.2 163.2 163.2 163.2 37.4 46.9 46.9 46.9 150.1 140.2 140.2 140.2 95.1 109.6 109.6 109.6 Total remuneration 1,649.6 1,706.8 225.0 2,578.6 773.7 828.3 93.1 1,273.3 1,146.3 1,124.1 126.6 1,694.1 1,188.8 1,276.8 139.3 1,926.8 1 Year of payment

2 Maximum value when awarded, amount paid out dependent upon the share price in the year of payment and the dividends paid until such time.

3 In the case of Mr. Althoff the dividend also refers to share awards from his work as a senior executive at Hannover Re.

4 For details of the service cost see the table Pension commitments on page 127. The service costs for Mr. Chèvre and Mr. Miller refer to the funding contribution for 2016 and for the first time to the personnel expense for 2017.Benefits granted Dr. Klaus Miller

Board member with divisional responsibilityDr. Michael Pickel

Board member with divisional responsibilityRoland Vogel

Chief Financial Officerin EUR thousand 2016 2017 2017

(Min)2017

(Max)2016 2017 2017

(Min)2017

(Max)2016 2017 2017

(Min)2017

(Max)Fixed remuneration 356.1 374.0 374.0 374.0 356.1 374.0 374.0 374.0 422.9 450.7 450.7 450.7 Fringe benefits 3.9 3.1 3.1 3.1 12.6 19.8 19.8 19.8 17.0 16.5 16.5 16.5 Total 360.0 377.1 377.1 377.1 368.7 393.8 393.8 393.8 439.9 467.2 467.2 467.2 One-year variable remuneration 288.0 288.0 0.0 576.0 288.0 288.0 0.0 576.0 288.0 382.5 0.0 765.0 Multi-year variable remuneration 223.1 221.3 (330.7) 413.3 224.2 222.7 (329.3) 414.7 224.8 285.7 (373.7) 540.7 Bonusbank 2015 (20191) / 2016 (20201) 96.0 96.0 (360.0) 192.0 96.0 96.0 (360.0) 192.0 96.0 127.5 (404.4) 255.0 Share Awards 2015 (20201) / 2016 (20211)2 96.0 96.0 0.0 192.0 96.0 96.0 0.0 192.0 96.0 127.5 0.0 255.0 Dividend on share awards for 2014 31.1 0.0 0.0 0.0 32.2 0.0 0.0 0.0 32.8 0.0 0.0 0.0 Dividend on share awards for 2015 0.0 29.3 29.3 29.3 0.0 30.7 30.7 30.7 0.0 30.7 30.7 30.7 Total 871.1 886.4 46.4 1,366.4 880.9 904.5 64.5 1,384.5 952.7 1,135.4 93.5 1,772.9 Service cost4 89.0 86.1 86.1 86.1 123.4 152.8 152.8 152.8 53.8 53.8 53.8 53.8 Total remuneration 960.1 972.5 132.5 1,452.5 1,004.3 1,057.3 217.3 1,537.3 1,006.5 1,189.2 147.3 1,826.7 1 Year of payment

2 Maximum value when awarded, amount paid out dependent upon the share price in the year of payment and the dividends paid until such time.

3 In the case of Mr. Althoff the dividend also refers to share awards from his work as a senior executive at Hannover Re.

4 For details of the service cost see the table Pension commitments on page 127. The service costs for Mr. Chèvre and Mr. Miller refer to the funding contribution for 2016 and for the first time to the personnel expense for 2017.German Corporate Governance Code, Item 4.2.5 Para. 3 – Table 2 (cash allocations in 2016 and 2017) Allocation Ulrich Wallin

Chief Executive OfficerSven Althoff

Board member with divisional responsibilityClaude Chévre

Board member with divisional responsibilityJürgen Gräber

Board member with divisional responsibility

Coordinator of worldwide property & casualty reinsurancein EUR thousand 2016 2017 2016 2017 2016 2017 2016 2017 Fixed remuneration 596.4 605.9 280.0 296.7 380.0 380.0 445.1 463.4 Fringe benefits 14.2 13.9 15.6 16.7 13.6 1.8 7.1 15.0 Total 610.6 619.8 295.6 313.4 393.6 381.8 452.2 478.4 One-year variable remuneration 1 717.6 722.4 362.4 363.6 463.8 474.0 534.6 519.0 Multi-year variable remuneration 916.2 710.2 44.6 135.3 173.8 346.3 676.0 554.1 Bonus bank 2012 / 2013 204.8 201.0 0.0 0.0 117.3 113.5 159.5 148.3 Share Awards 2011 / 2012 2 608.8 406.6 0.0 109.6 56.5 232.8 427.3 316.6 Stock participation rights 2010

(2015 – 2020 3)102.6 102.6 16.3 16.3 0.0 0.0 89.2 89.2 Stock participation rights 2011

(2016 – 2021 4)0.0 0.0 28.3 9.4 0.0 0.0 0.0 0.0 Total 2,244.4 2,052.4 702.6 812.3 1,031.2 1,202.1 1,662.8 1,551.5 Service cost 5 144.2 163.2 37.4 46.9 150.1 140.2 95.1 109.6 Total remuneration 2,388.6 2,215.6 740.0 859.2 1,181.3 1,342.3 1,757.9 1,661.1 1 This refers in each case to payment of the variable remuneration for the previous year. Remuneration for seats with Group bodies that is counted towards the variable remuneration accrues in the year of occurrence. The company’s Supervisory Board only decides on the final amount paid out for the 2017 financial year after the remuneration report has been drawn up.

2 In the case of Mr. Althoff the payment of share awards in 2012 relates to his work as a senior executive before his appointment as a member of the Executive Board.

3 Stock appreciation rights were awarded in 2010, exercise option at the discretion of the Executive Board until 31 December 2020 in the following tranches: 60% from 2015, 80% from 2016, 100% from 2017 onwards.

4 Stock appreciation rights were awarded to Mr. Althoff in 2011 as a senior executive, exercise option discretionary until 31 December 2021 in the following tranches: 60% from 2016, 80% from 2017, 100% from 2018 onwards

5 For details of the service cost see the table “Pension commitments” on page 127. The service costs for Mr. Chèvre and Mr. Miller refer to the funding contribution for 2016 and for the first time to the personnel expense for 2017.Allocation Dr. Klaus Miller

Board member with divisional responsibilityDr. Michael Pickel

Board member with divisional responsibilityRoland Vogel

Chief Financial Officerin EUR thousand 2016 2017 2016 2017 2016 2017 Fixed remuneration 356.1 374.0 356.1 374.0 422.9 450.7 Fringe benefits 3.9 3.1 12.6 19.8 17.0 16.5 Total 360.0 377.1 368.7 393.8 439.9 467.2 One-year variable remuneration 1 390.0 391.8 413.4 411.3 430.1 421.6 Multi-year variable remuneration 461.5 361.2 523.8 432.9 560.3 415.6 Bonus bank 2012 / 2013 117.3 113.5 117.3 119.8 126.0 120.8 Share Awards 2011 / 2012 2 329.3 232.8 326.2 232.8 389.7 250.2 Stock participation rights 2010

(2015 – 2020 3)14.9 14.9 80.3 80.3 44.6 44.6 Stock participation rights 2011

(2016 – 2021 4)0.0 0.0 0.0 0.0 0.0 0.0 Total 1,211.5 1,130.1 1,305.9 1,238.0 1,430.3 1,304.4 Service cost 5 89.0 86.1 123.4 152.8 53.8 53.8 Total remuneration 1,300.5 1,216.2 1,429.3 1,390.8 1,484.1 1,358.2 1 This refers in each case to payment of the variable remuneration for the previous year. Remuneration for seats with Group bodies that is counted towards the variable remuneration accrues in the year of occurrence. The company’s Supervisory Board only decides on the final amount paid out for the 2017 financial year after the remuneration report has been drawn up.

2 In the case of Mr. Althoff the payment of share awards in 2012 relates to his work as a senior executive before his appointment as a member of the Executive Board.

3 Stock appreciation rights were awarded in 2010, exercise option at the discretion of the Executive Board until 31 December 2020 in the following tranches: 60% from 2015, 80% from 2016, 100% from 2017 onwards.

4 Stock appreciation rights were awarded to Mr. Althoff in 2011 as a senior executive, exercise option discretionary until 31 December 2021 in the following tranches: 60% from 2016, 80% from 2017, 100% from 2018 onwards

5 For details of the service cost see the table “Pension commitments” on page 127. The service costs for Mr. Chèvre and Mr. Miller refer to the funding contribution for 2016 and for the first time to the personnel expense for 2017. -

Sideline activities of the members of the Executive Board

The members of the Executive Board require the approval of the Supervisory Board to take on sideline activities. This ensures that neither the remuneration granted nor the time required for this activity can create a conflict with their responsibilities on the Executive Board. If the sideline activities involve seats on supervisory boards or comparable control boards, these are listed and published in the Annual Report of Hannover Rück SE. The remuneration received for such seats at Group companies and other board functions is deducted when calculating the variable bonus and shown separately in the table of total remuneration.

-

Retirement provision

Defined benefit pension commitment (appointment before 2009)

The contracts of members of the Executive Board first appointed prior to 2009 contain commitments to an annual retirement pension calculated as a percentage of the pensionable fixed annual remuneration (defined benefit). The target pension is at most 50% of the monthly fixed salary payable on reaching the age of 65. A non-pensionable fixed remuneration component was introduced in conjunction with the remuneration structure applicable from 2011 onwards.

Defined contribution pension commitment (appointment from 2009 onwards)

The commitments given to members of the Executive Board from 2009 onwards are based on a defined contribution scheme.

A Board member who has reached the age of 65 and left the company’s employment receives a life-long retirement pension. The amount of the monthly retirement pension is calculated according to the reference date age (year of the reference date less year of birth) and the funding contribution on the reference date. The annual funding contribution for these contracts is paid by the company in the amount of a contractually specified percentage of the pensionable income (fixed annual remuneration as at the contractually specified reference date).

In both contract variants (i. e. defined benefit and defined contribution) other income received while drawing the retirement pension is taken into account pro rata or in its entirety under certain circumstances (e. g. in the event of incapacity for work or termination of the service contract before reaching the age of 65).

Provision for surviving dependants

If the Board member dies during the period of the service contract, the surviving spouse – or alternatively the eligible children – shall be entitled to continued payment of the fixed monthly salary for the month in which the Board member dies and the six months thereafter, at most until termination of the service contract. If the member of the Executive Board dies after pension payments begin, the surviving spouse and alternatively the dependent children shall receive continued payment of the retirement pension for the month of death and the following six months.

The widow’s pension amounts to 60% of the retirement pay that the Board member received or would have received if he had been incapacitated for work at the time of his death.

An orphan’s pension shall be granted in the amount of 15% – in the case of full orphans 25% (final-salary pension commitment) or 30% (contribution-based pension commitment) – of the retirement pay that the Board member received or would have received on the day of his death if the pensionable event had occurred owing to a permanent incapacity for work.

Adjustments

The following parameters are used for adjustments to retirement, widow’s and orphan’s benefits: the price index for the cost of living of all private households in Germany (contracts from 2001 onwards) or the price index for the cost of living of four-person households of civil servants and higher-income salaried employees (contracts from 1997 to 2000).

Current pensions based on the commitments given from 2009 onwards (defined contribution commitment) are increased annually by at least 1% of their most recent (gross) amount.

Pension payments to former members of the Executive Board

The pension payments to former members of the Executive Board and their surviving dependants, for whom 17 (16) pension commitments existed, totalled EUR 1.6 million (EUR 1.6 million) in the year under review. The projected benefit obligation of the pension commitments to former members of the Executive Board amounted to altogether EUR 24.7 million (EUR 25.3 million).

Pension commitments Name

in EUR thousandFinancial year Attainable annual pension (age 65) DBO 31.12. Personnel expense Annual funding contribution1 Premium Ulrich Wallin 2017 257.5 5,830.6 163.2 – – 2016 229.1 5,370.1 144.2 – – Sven Althoff2,3 2017 92.5 1,222.4 46.9 25% 70.0 2016 92.2 1,185.3 37.4 25% 70.0 Claude Chèvre4 2017 118.7 868.8 140.2 39.5% 150.1 2016 118.4 731.7 – 39.5% 150.1 Jürgen Gräber 2017 182.5 3,840.2 109.6 – – 2016 182.5 3,731.1 95.1 – – Dr. Klaus Miller4 2017 55.0 652.2 86.1 25% 93.5 2016 53.3 557.8 – 25% 89.0 Dr. Michael Pickel 2017 160.0 2,712.5 152.8 – – 2016 135.5 2,509.2 123.4 – – Roland Vogel 2,5 2017 96.9 1,674.9 53.8 25% 110.4 2016 94.3 1,623.5 53.8 25% 105.7 Total 2017 963.1 16,801.6 752.6 424.0 Total 2016 905.3 15,708.7 453.9 414.8 1 Percentage of pensionable income (fixed annual remuneration as at the contractually specified reference date).

2 Mr. Althoff and Mr. Vogel were first granted a pension commitment prior to 2001 on the basis of their service to the company prior to their appointment to the Executive Board; the earned portion of the commitment from the Unterstützungskasse is therefore established as a proportion (in the ratio [currently attained service years since entry] / [attainable service years from entry to exit age]) of the final benefit. Measurement under IAS 19 consequently uses the defined benefit method. The values shown include the entitlements prior to appointment to the Executive Board, which in accordance with a resolution of the company’s Supervisory Board shall remain unaffected by the pension commitment as a member of the Executive Board.

3 The guaranteed interest rate is 3.25%.

4 Measured under IAS 19 as a defined benefit commitment for the first time as at 31 December 2016. The guaranteed interest rate is 2.25%.

5 The guaranteed interest rate under the basic insurance is 3.25%; the interest rate for the bonus insurance is 1.25%.

More Information

Topic related links within the report:

Share 8.3 Share-based payment Declaration on Corporate Governance Enterprise managementTopic related links outside the report:

Executive Board